The Latte Factor by David Bach: 7 Powerful Truths That Could Change Your Life

In today’s fast-paced consumer-driven society, many individuals find themselves living paycheck to paycheck, unable to save or invest for their future. Amidst this chaos comes a small book with a mighty impact — The Latte Factor by David Bach. Though compact in size, its message is monumental. The book reveals that the path to financial freedom is not built on complex strategies or massive income but rather on simple, everyday decisions.

In this detailed review of The Latte Factor by David Bach, we will uncover the essential lessons the book offers, explore its life-changing ideas, and evaluate how it can influence your financial habits. By the end of this post, you’ll understand why this book isn’t just another personal finance manual but a philosophy that can truly redefine your relationship with money.

1. The Latte Factor by David Bach — What Is It Really About?

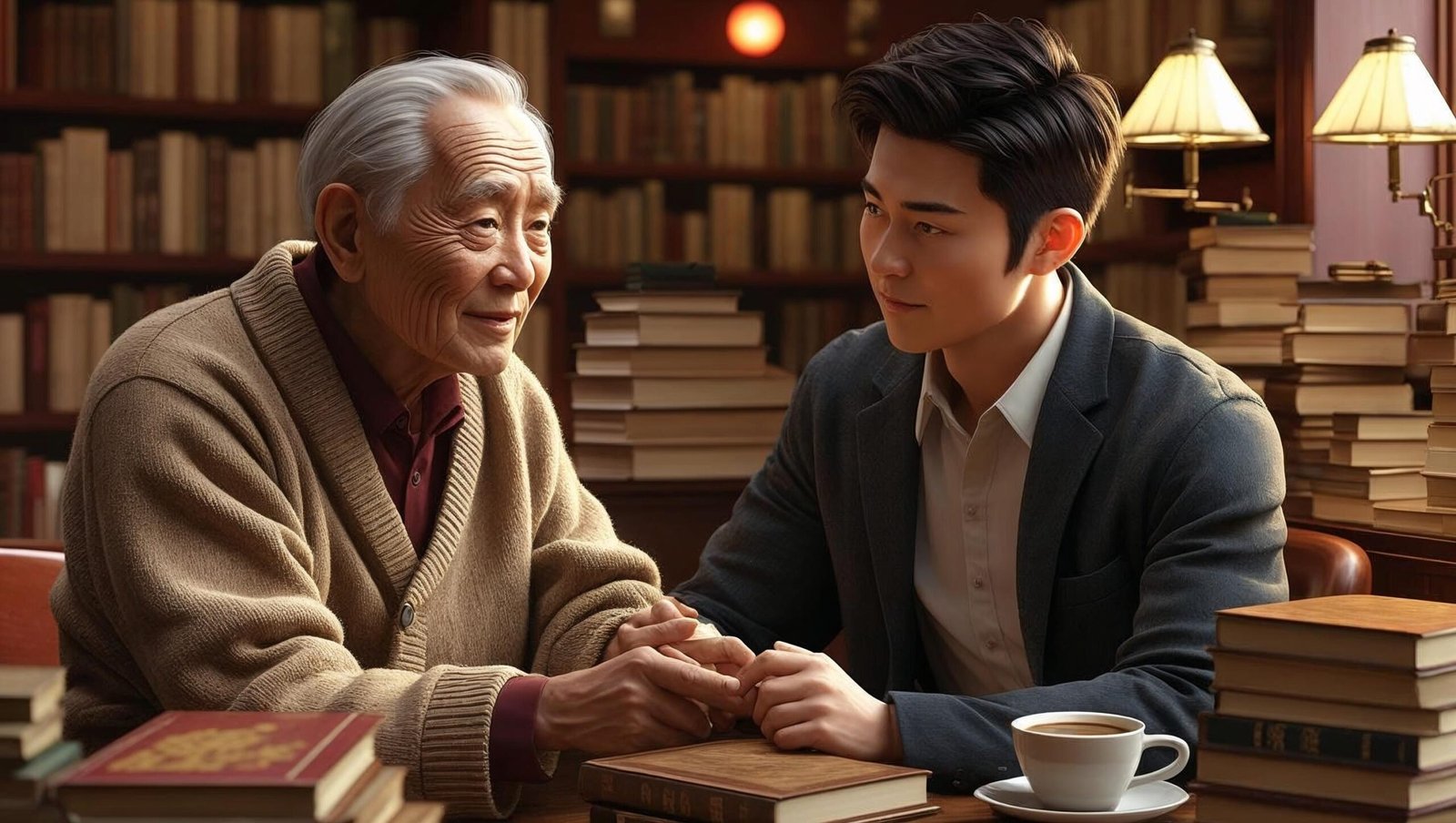

The Latte Factor by David Bach is not a traditional financial guide filled with spreadsheets and investment lingo. Instead, it’s a fictional story about a young woman named Zoey Daniels who learns vital life and money lessons from an older mentor, Henry. Set in the vibrant city of New York, Zoey’s daily routine, including her morning coffee, becomes the catalyst for understanding the core message: small, seemingly insignificant daily expenses add up and can be redirected to build long-term wealth.

This narrative form makes the book not only accessible but also deeply relatable. The Latte Factor by David Bach appeals to readers of all ages and financial backgrounds, proving that anyone — regardless of income — can achieve financial freedom.

2. Key Principle #1: Pay Yourself First

One of the foundational ideas presented in The Latte Factor by David Bach is the timeless concept of paying yourself first. Zoey learns that before spending a single dime on bills or luxuries, she should set aside a portion of her income into savings and investments.

This principle encourages automatic saving habits. By treating saving as a non-negotiable, you gradually build wealth without conscious effort. The Latte Factor by David Bach stresses that even small contributions — say $5 a day — can accumulate to significant wealth over time when invested smartly.

3. Key Principle #2: Make It Automatic

Automation is a recurring theme in The Latte Factor by David Bach. The book suggests automating savings, debt repayments, and investments. This removes human error and emotional decision-making, which often derail long-term financial plans.

Through Zoey’s journey, David Bach illustrates how automation transforms financial chaos into clarity. You don’t need to micromanage your finances; you just need to set up systems that work silently in the background.

4. Key Principle #3: Live Rich Now

Surprisingly, The Latte Factor by David Bach isn’t about deprivation. It advocates for living richly — not by spending extravagantly, but by spending intentionally. Zoey’s transformation reveals that real wealth lies in experiences, relationships, and freedom, not just in the numbers in your bank account.

The book urges readers to reflect on what they truly value. Instead of mindless spending on things that offer momentary pleasure, channel your money towards what truly brings joy and fulfillment. The Latte Factor by David Bach shows that intentional living leads to lasting happiness.

5. Real-Life Applications of The Latte Factor

What makes The Latte Factor by David Bach powerful is its applicability. Here are some real-life ways to implement its teachings:

-

Track Your Daily Expenses: Understand where your money goes. Those small, untracked expenses might be the reason your savings don’t grow.

-

Create a “Latte Factor” Fund: Identify one recurring, non-essential expense and redirect that amount to a high-interest savings account.

-

Start Investing Small: Use platforms like SIPs or micro-investing apps to begin investing even with tiny amounts.

-

Automate and Forget: Set up automatic transfers to your savings or retirement account the moment you receive your salary.

The Latte Factor by David Bach proves that wealth-building isn’t just for the wealthy — it’s for the intentional.

6. Why the Latte Metaphor Matters

The metaphor of the latte is symbolic. In The Latte Factor by David Bach, the daily coffee is not the villain; it’s a representation of all the unconscious spending that happens throughout the day.

That $4 latte, when spent daily, could equal over $100 a month or more than $1,200 a year. Invested wisely, it could become hundreds of thousands of dollars over decades. The key is awareness and redirection of funds — a core message emphasized repeatedly in The Latte Factor by David Bach.

7. The Psychological Shift — From Scarcity to Abundance

One of the most significant shifts the book offers is psychological. The Latte Factor by David Bach encourages readers to move from a scarcity mindset to an abundance mindset.

Zoey begins with the belief that she “can’t afford to save.” By the end, she realizes that she always had the money — she just wasn’t mindful of how she used it. This mental transformation is arguably more important than any budgeting technique.

8. Strengths of the Book

-

Simplicity: The Latte Factor by David Bach simplifies personal finance so that even novices can grasp it.

-

Storytelling: Using fiction to teach finance makes it memorable and emotional.

-

Universal Message: No matter your income level or age, the core concepts apply to everyone.

9. Criticism and Limitations

No book is perfect. The Latte Factor by David Bach has been criticized for oversimplifying financial success. Critics argue that while skipping a daily latte can help, it won’t resolve deeper financial issues like student loans, medical debt, or stagnant wages.

However, the book never claims to be a complete financial blueprint. Its purpose is to spark awareness and begin a shift in mindset, not replace comprehensive financial planning.

10. The Latte Factor by David Bach vs. Traditional Finance Books

Traditional personal finance books focus on compound interest charts, financial jargon, and rigid budgeting. In contrast, The Latte Factor by David Bach connects emotionally and offers immediate actionable advice. It bridges the gap between financial theory and daily life.

Rather than telling you what to do with your money, the book helps you discover your own truths about money, time, and values.

11. Understanding the Power of Compounding in Daily Life

One of the often understated yet critical concepts underlying the book’s philosophy is compound growth. While this term is frequently associated with financial portfolios and long-term investments, its influence extends far beyond money. Compounding can transform not just savings but also habits, relationships, skills, and health.

Take, for instance, learning a new language or skill. Devoting just 15 minutes a day might seem insignificant. But over months and years, this investment of time builds into fluency or mastery. The same applies to relationships—consistent, small gestures of love, gratitude, or attention add up to long-term intimacy and trust.

When readers grasp this idea, they begin to see the value of time differently. Every moment becomes an opportunity. Every habit, no matter how trivial, becomes a building block. This is where the wisdom in Zoey’s story extends beyond financial literacy into personal mastery. Time becomes wealth, not in the form of currency, but in the richness of experience and potential.

12. The Emotional Toll of Financial Stress

Financial stress is more than just a budgeting problem—it affects our mental well-being, sleep quality, personal relationships, and even job performance. One of the subtle strengths of this book is its acknowledgment of the emotional and psychological impact of money, even though it’s wrapped in a light narrative.

Many people suffer silently under the weight of credit card bills, rent, or the constant worry of “what if something goes wrong?” This kind of chronic anxiety leads to decision fatigue, low self-esteem, and burnout. But the book offers hope—not through miracle cures, but through everyday discipline and mindfulness.

By taking control of even a small portion of your finances, you reclaim agency. You shift from reactive to proactive. Financial stability doesn’t arrive overnight, but the mental relief of starting the journey can be instantaneous.

13. Micro-Spending and the Death by a Thousand Cuts

The concept of “death by a thousand cuts” perfectly describes how unconscious micro-spending eats away at potential savings. It’s not just the morning coffee—it’s the takeout on nights when cooking feels tiring, the unused subscriptions, the impulse buys prompted by clever digital ads.

This slow drain is deceptive because none of these expenses feel extreme in isolation. But when stacked together over time, they shape your financial destiny. This phenomenon reveals why traditional budgeting often fails. People track major expenses—rent, loans, tuition—but ignore the hundreds of tiny leaks that collectively sink the ship.

The solution isn’t self-deprivation, but self-awareness. Journaling your spending for even one week can be a wake-up call. And once you identify patterns, you can make empowered choices.

14. Minimalism and Financial Clarity

There is an interesting alignment between the philosophy presented in this book and the minimalist lifestyle. Minimalism isn’t about owning nothing—it’s about owning what matters. Financial freedom and minimalist values often go hand in hand because both advocate for intentionality.

Clearing financial clutter means more than cutting expenses—it’s about eliminating complexity. A minimalist budget may have fewer categories, fewer accounts, and fewer purchases, but each element has purpose. This decluttering process creates mental bandwidth and emotional peace.

Just as minimalism asks, “Does this bring value to my life?” your financial decisions can mirror that question. If your daily choices don’t align with your values, you’re living in contradiction. The book provides a roadmap for realignment.

15. Teaching Financial Wisdom to the Next Generation

One overlooked application of the book’s message lies in financial education for younger generations. Whether you’re a parent, teacher, or mentor, introducing these concepts early can change the trajectory of a child’s life.

Imagine a teenager who understands compounding before their first paycheck. Imagine a college student who values saving over spending. These small mindset shifts can create a generation that’s not just financially literate but financially empowered.

Storytelling is a potent tool in education, which is why a narrative-based book like this can be more effective than a dry curriculum. It shows, rather than tells. Children remember stories. They remember characters like Zoey who learn relatable lessons. This makes abstract financial concepts tangible and actionable.

16. Behavioral Finance and Money Psychology

A fascinating layer beneath the book’s surface is its subtle use of behavioral economics. It doesn’t just tell you what to do—it helps you understand why you don’t do it already. Why do people struggle to save even when they know they should? Why do emotions overpower logic when making financial decisions?

The answer lies in how our brains are wired. We seek immediate rewards. We overestimate our self-control. We feel the pain of losses more intensely than the joy of gains. Understanding these tendencies is crucial if we want to overcome them.

By simplifying the path to financial habits—through automation, visualization, and simplicity—the book nudges readers toward better behaviors without relying on willpower alone. It’s a behavioral blueprint wrapped in a story.

17. The Danger of Consumer Culture

Our culture is saturated with marketing messages. Everywhere we turn, we’re told we need more—more gadgets, more clothes, more luxury experiences. This creates a perpetual feeling of inadequacy. The underlying belief is: “Once I buy this, I’ll be happier.”

But as countless studies have shown, happiness doesn’t scale with spending past a certain point. What does correlate with happiness? Security. Autonomy. Purpose. Time affluence. The Latte Factor by David Bach encourages a revaluation of priorities.

When you learn to distinguish between advertising noise and your authentic desires, you reclaim your power. You start buying less and living more. This mental shift is arguably the most liberating aspect of the book.

18. Real Case Study: From Struggling to Stable

Let’s consider a real-world example. Raj, a 31-year-old graphic designer from Delhi, earned a decent income but lived paycheck to paycheck. His monthly rent, phone bills, and subscriptions were manageable, but somehow his bank balance remained low.

After reading The Latte Factor by David Bach, Raj decided to conduct a one-month audit of his spending. The results surprised him. Over ₹12,000 was spent on food deliveries, app subscriptions, and coffee runs. He cancelled three subscriptions, cooked at home three times a week, and redirected ₹6,000 monthly into a recurring deposit.

Within a year, Raj saved over ₹70,000. He now has a small emergency fund, started investing in mutual funds, and feels less stressed. More importantly, he gained confidence and control over his finances. The book didn’t give him a secret—it gave him awareness.

19. Financial Freedom as a Daily Practice

Financial freedom is not a one-time achievement. It’s a daily practice. Every decision you make—whether to splurge or save, to spend mindlessly or mindfully—either brings you closer to or further from your goals.

The beauty of this philosophy is that you don’t need to wait for a promotion, inheritance, or windfall. You can start with what you have, right now. The act of redirecting even ₹100 a day with purpose shifts your identity from spender to investor, from victim to creator.

And once this identity shift happens, momentum takes over. You start building not just wealth, but self-respect. That’s the invisible dividend of financial literacy.

20. Is It Ever Too Late to Start?

One concern many readers have is, “I’m already in my 40s or 50s. Is it too late to apply these lessons?” The answer is a resounding no.

While starting early gives compound interest more time to work, the principles apply at any stage. Even if you’re in debt or have minimal savings, what matters most is taking the first step today. Progress isn’t linear—it accelerates with consistency.

The book doesn’t promise magic. It promises progress. And no matter your age or background, that promise holds true.

Conclusion: Reimagining Wealth as Freedom

The added wisdom within this blog post strengthens the core message of The Latte Factor by David Bach — that wealth isn’t about earning more, but about choosing better. When you become conscious of how you spend, where your money flows, and what you prioritize, you unlock a version of life that’s richer in every sense.

As readers, we must ask ourselves: What is our true latte factor? What daily choice, expense, or mindset is holding us back from the life we truly want?

The answer lies not in your bank account, but in your habits. And the best part? You can change them starting today.

FAQs

Q1: Is The Latte Factor by David Bach suitable for beginners?

Yes. The book is written in simple language and uses storytelling, making it easy to understand and ideal for readers new to personal finance.

Q2: Can small savings really make a big difference?

Absolutely. The Latte Factor by David Bach proves that consistent small savings, when invested wisely, can lead to substantial wealth over time.

Q3: Is this book only about cutting down on coffee?

Not at all. The latte is just a metaphor for any daily expense that isn’t necessary. The real lesson is about becoming mindful of your spending.

Q4: How long does it take to see results if I apply the book’s advice?

With consistent application, you can see changes in your savings habits within a few months. Long-term investment returns will take time but are worth the patience.

Q5: What’s the biggest takeaway from The Latte Factor by David Bach?

The biggest lesson is that you don’t need to be rich to start building wealth. You need awareness, intentionality, and the discipline to pay yourself first.

Read more insightful reviews and life-changing lessons at:

🌐 shubhanshuinsights.com