Introduction: Why Rich Dad Poor Dad by Robert Toru Kiyosaki Still Matters

When it comes to transforming financial thinking, few books have had as wide and lasting an impact as Rich Dad Poor Dad by Robert Toru Kiyosaki. First published in 1997, this bestseller revolutionized how millions across the globe perceive wealth, work, and success. In this detailed review of Rich Dad Poor Dad by Robert Toru Kiyosaki, we delve into the core messages that continue to inspire readers—even decades later.

This isn’t just another self-help book; it is a paradigm shift. Whether you’re a student dreaming of freedom, a professional stuck in the 9-to-5 grind, or a budding entrepreneur, Rich Dad Poor Dad by Robert Toru Kiyosaki can serve as your financial awakening.

About the Author: Robert Toru Kiyosaki

Robert Toru Kiyosaki is more than just a financial educator—he’s a revolutionary thinker. As a successful investor, entrepreneur, and motivational speaker, his goal has always been to elevate the world’s financial IQ. In Rich Dad Poor Dad by Robert Toru Kiyosaki, he recounts the contrasting lessons he received from two father figures: his educated but financially struggling biological father (Poor Dad), and his friend’s wealthy entrepreneur father (Rich Dad).

This dual perspective forms the basis of Rich Dad Poor Dad by Robert Toru Kiyosaki, a compelling exploration of how two sets of beliefs can lead to dramatically different outcomes in life.

1. Lesson One: Financial Education is Power

The most consistent message in Rich Dad Poor Dad by Robert Toru Kiyosaki is that financial literacy trumps traditional education. Rich Dad insists on learning how money works, while Poor Dad urges young Robert to chase job security.

“In school, we learn to work for money. In life, you must learn how to make money work for you.”

This foundational idea sets Rich Dad Poor Dad by Robert Toru Kiyosaki apart from most personal finance guides. It’s not about tips and tricks—it’s about mindset and education.

2. Lesson Two: The Illusion of Job Security

Through his vivid storytelling, Rich Dad Poor Dad by Robert Toru Kiyosaki dispels the myth that a secure job ensures wealth. Poor Dad believes in steady income, pensions, and government jobs. In contrast, Rich Dad builds businesses and invests in assets.

This lesson resonates deeply with Indian readers, many of whom grow up aspiring for government or MNC jobs. But Rich Dad Poor Dad by Robert Toru Kiyosaki urges us to look beyond the illusion and question whether our jobs are building wealth or just sustaining us.

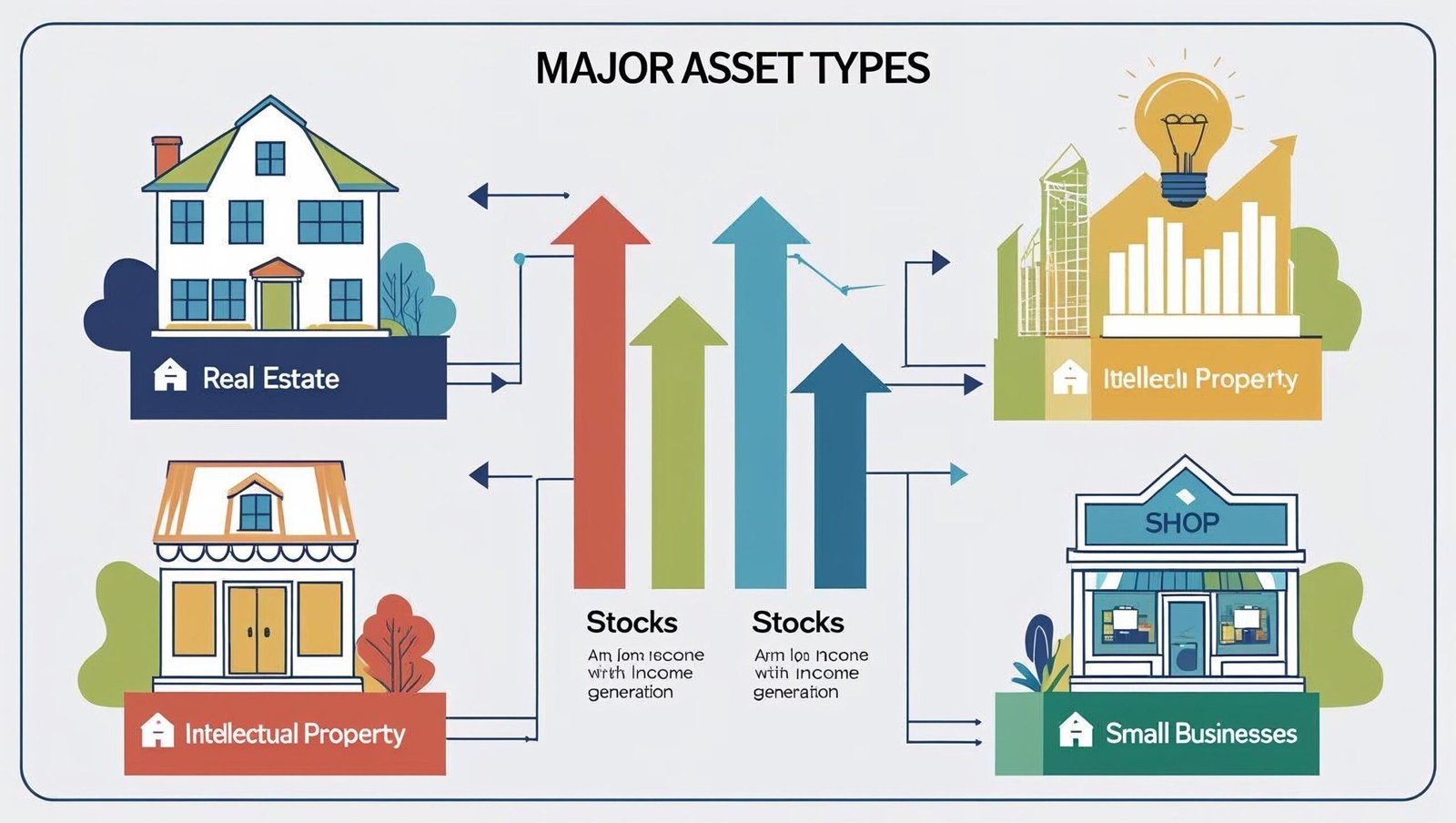

3. Lesson Three: Build Assets, Not Liabilities

Arguably the most quoted principle in Rich Dad Poor Dad by Robert Toru Kiyosaki is:

“The rich acquire assets. The poor and middle class acquire liabilities they think are assets.”

Assets are things that put money into your pocket—stocks, real estate, intellectual property. Liabilities, on the other hand, take money out—loans, credit card debt, and even your house if it doesn’t generate income.

Rich Dad Poor Dad by Robert Toru Kiyosaki offers a clear distinction, urging readers to focus on acquiring real, income-producing assets.

4. Lesson Four: Escape the Rat Race

One of the most vivid metaphors in Rich Dad Poor Dad by Robert Toru Kiyosaki is the Rat Race—the cycle of working, earning, spending, and repeating. It’s a lifestyle driven by fear and comfort, keeping people stuck financially.

To escape it, Rich Dad Poor Dad by Robert Toru Kiyosaki recommends rethinking our relationship with work and money. Instead of asking, “How can I afford this?” we should ask, “How can I generate income to make this possible?”

5. Lesson Five: Take Calculated Risks

Fear of failure often stops people from exploring financial opportunities. In Rich Dad Poor Dad by Robert Toru Kiyosaki, Rich Dad encourages Robert to welcome failure as part of growth, while Poor Dad treats it as shame.

“Losers are people who are afraid of losing.”

This empowering philosophy makes Rich Dad Poor Dad by Robert Toru Kiyosaki a favorite among entrepreneurs and risk-takers. It teaches you that failure is not the opposite of success, but a stepping stone toward it.

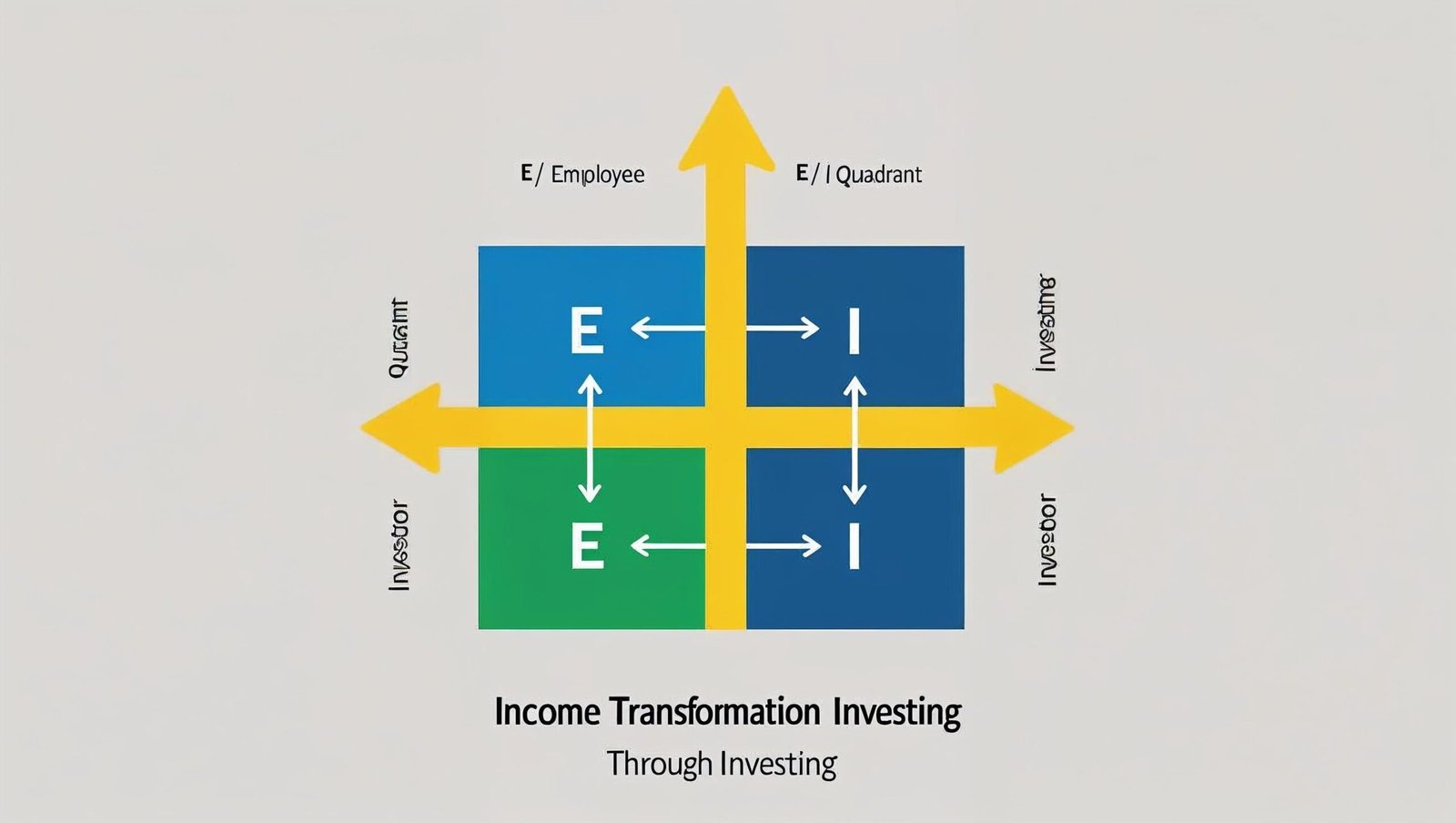

6. Lesson Six: Own Your Business

Rich Dad Poor Dad by Robert Toru Kiyosaki warns readers not to confuse employment with ownership. Your job might offer a paycheck, but it doesn’t provide real freedom.

Rich Dad teaches that true wealth comes from owning your business or assets—not working in someone else’s. This section in Rich Dad Poor Dad by Robert Toru Kiyosaki advocates side hustles, passive income, and tax intelligence.

7. Lesson Seven: Financial Education is a Lifelong Journey

The final lesson in Rich Dad Poor Dad by Robert Toru Kiyosaki emphasizes that financial literacy doesn’t stop after reading one book. It is an ongoing process of learning about taxes, investments, real estate, and changing economic trends.

This lesson makes Rich Dad Poor Dad by Robert Toru Kiyosaki a gateway book, one that opens the door to a lifelong pursuit of financial independence.

The Psychology Behind Wealth Creation

Financial success is not merely a game of numbers; it’s predominantly a mental and emotional journey. Those who accumulate significant wealth often do so because of their ability to master not only money but also themselves. It begins with understanding fear, desire, and discipline—three pivotal elements that govern human behavior when it comes to finances.

Most individuals fear poverty more than they desire wealth. As a result, they conform to secure jobs, traditional savings, and limited aspirations. Instead of pursuing financial independence, they settle for survival. This conditioning stems from early exposure to societal norms that equate stability with security.

The difference between wealthy individuals and those who struggle financially often lies in mindset. The former group learns to manage risk, adapt to change, and invest in education beyond academia. They study human behavior, economic patterns, and market dynamics to make informed decisions.

The Role of Passive Income

A critical concept in financial independence is the generation of revenue streams that do not rely on active labor. Passive income may come from investments, rental properties, royalties, or digital products. The advantage of such income lies in its scalability and sustainability.

Unlike salaries, which are fixed and time-bound, income from autonomous systems continues to flow regardless of one’s daily involvement. It allows for greater time freedom, flexibility, and reduced stress over long-term financial planning.

To build such income, one needs to focus on asset acquisition and skill enhancement. It demands patience and a strategic approach. One must also overcome the temptation of short-term gratification in exchange for long-term stability.

Breaking Free from Consumerism

In today’s hyper-commercial society, consumption is often mistaken for success. The more one earns, the more one spends—on cars, gadgets, holidays, or lifestyle upgrades. While these can bring temporary satisfaction, they often create a loop of dependency on active income.

True wealth lies in reducing unnecessary expenses and redirecting savings toward compounding opportunities. This requires financial self-awareness. Monitoring where money flows each month, evaluating needs versus wants, and making value-based decisions can transform personal finances over time.

Minimalism, though often misunderstood, is not about deprivation. It’s about prioritization. It empowers individuals to focus on what truly adds meaning and value to their lives.

Understanding the Tax Game

One of the least taught but most essential areas of finance is taxation. Tax laws can either become a burden or a strategic advantage, depending on how well one understands them.

High-income earners in traditional employment often pay more taxes than entrepreneurs or investors. This is because business owners can deduct operational costs, while salaried individuals usually cannot. Learning how the system works can drastically shift financial outcomes.

By forming legal structures such as limited liability companies or trusts, individuals can optimize their tax obligations. This is not about evasion, but intelligent planning. It rewards those who take the time to understand fiscal policy and navigate it wisely.

The Emotional Journey of Financial Independence

Beyond strategies and numbers lies the emotional journey of liberation. Financial stress is among the leading causes of anxiety, depression, and conflict in families. When individuals lack control over their earnings or debt, it seeps into their health and relationships.

Achieving stability is a deeply personal goal. It provides peace of mind, confidence, and the ability to pursue passions without compromise. The journey is often filled with setbacks—bad investments, unexpected losses, or economic downturns—but resilience comes from clarity and purpose.

Journaling financial goals, reviewing progress regularly, and surrounding oneself with like-minded communities can make the path smoother and more fulfilling.

Learning from Failure

No financial journey is devoid of mistakes. Many successful entrepreneurs and investors have suffered losses, bankruptcies, or bad decisions. What sets them apart is the capacity to learn and adapt.

Failure should be viewed as feedback. Each setback offers lessons—about market behavior, timing, psychology, or one’s own blind spots. Instead of allowing failure to create paralysis, one should convert it into momentum.

Books, podcasts, mentorships, and communities that share authentic stories of financial missteps can be more educational than dry theoretical materials. Embracing vulnerability in finance is a strength, not a weakness.

The Influence of Financial Role Models

In many households, financial education is either absent or rooted in fear-based thinking. Children often inherit their parents’ beliefs about money, whether it’s scarcity, guilt, or anxiety.

It is crucial, therefore, to seek out mentors or role models who demonstrate healthy relationships with wealth. These can be successful entrepreneurs, ethical investors, or thought leaders in the financial space.

The benefit of surrounding oneself with financially intelligent individuals is multifaceted. It accelerates learning, provides accountability, and introduces new opportunities.

One doesn’t need physical proximity; access through online platforms, webinars, and books is sufficient to model successful behaviors.

Diversification and Long-Term Thinking

One of the golden rules in personal finance is diversification. Placing all funds in a single vehicle—whether a job, a stock, or a property—invites risk. A balanced portfolio might include equities, fixed income, real estate, digital assets, and even creative income streams.

This principle, however, requires time and research. Not all investments suit everyone. Age, income, goals, and risk appetite must all be factored into a sound financial plan.

Long-term thinking is another missing ingredient in most financial plans. Many individuals are swayed by short-term gains or sensational news. A well-structured strategy thrives on consistency, patience, and a deep understanding of economic cycles.

The Connection Between Purpose and Wealth

Money, in its highest form, is a tool for freedom and service. Beyond personal comforts, wealth allows one to contribute meaningfully to causes, people, and innovations.

When earning is driven solely by survival or vanity, it creates emptiness. When it’s tied to vision and value, it brings fulfillment. Aligning income generation with life purpose transforms it from a burden to a blessing.

Many financially free individuals report that their real joy comes not from what they have, but from what they can give—be it time, wisdom, or philanthropy.

The Role of Education Reform

Current schooling systems, especially in many countries, lack any serious curriculum on practical finance. Students graduate knowing trigonometry and Shakespeare but remain unaware of how taxes, investments, or credit systems work.

Change must begin at home and in communities. Parents, teachers, and thought leaders should prioritize early financial exposure—using simulations, games, real-life examples, and storytelling.

Literacy is no longer enough. Financial fluency must be regarded as a life skill. Empowering the next generation requires more than textbook knowledge; it requires empowerment through relevance.

Taking Your First Steps Today

Change doesn’t happen overnight, but it must begin today. Start by:

-

Tracking your expenses for one month

-

Reading at least one finance-related book

-

Signing up for an investing or budgeting app

-

Discussing money openly and positively with your family

-

Setting one financial goal (saving ₹10,000, investing in an index fund, starting a side hustle)

Every step taken in awareness becomes a brick in the foundation of financial independence.

Looking Ahead

The road to wealth is not paved with shortcuts. It is a blend of knowledge, patience, failure, courage, and deep introspection. As the world continues to evolve—technologically, economically, and socially—those who understand money will remain ahead.

This extension aims to continue that journey with you—one mindful, practical, and empowering lesson at a time.

Impact of Rich Dad Poor Dad by Robert Toru Kiyosaki in India

In a country like India where financial planning often revolves around gold, fixed deposits, and LIC policies, Rich Dad Poor Dad by Robert Toru Kiyosaki brings a refreshing and much-needed perspective. It encourages Indians to explore the stock market, invest in businesses, and rethink their inherited beliefs about money.

Key Takeaways Table

| Concept | Poor Dad Belief | Rich Dad Strategy |

|---|---|---|

| Education | Academic degrees | Financial education |

| Career | Safe, stable job | Own business/invest |

| Risk | Avoid at all costs | Take smart risks |

| Money | Work for money | Make money work for you |

| Assets | Not a focus | Critical to wealth |

This comparison table highlights the opposing philosophies that define Rich Dad Poor Dad by Robert Toru Kiyosaki.

Criticism and Balanced View

A thorough review of Rich Dad Poor Dad by Robert Toru Kiyosaki must acknowledge criticisms. Critics say the book oversimplifies and lacks practical, actionable steps. However, its strength lies in challenging mental blocks and offering a fresh narrative about money.

If you’re looking for exact investment strategies, this might not be the book. But if you seek a new mindset, Rich Dad Poor Dad by Robert Toru Kiyosaki delivers.

FAQs About Rich Dad Poor Dad by Robert Toru Kiyosaki

Q1: Who should read Rich Dad Poor Dad by Robert Toru Kiyosaki?

Anyone interested in financial freedom—students, working professionals, homemakers, and entrepreneurs.

Q2: Is the book relevant for Indian readers?

Yes. Rich Dad Poor Dad by Robert Toru Kiyosaki challenges beliefs that are also deeply rooted in Indian society.

Q3: Is it a practical or philosophical book?

Primarily philosophical. While it lacks detailed steps, Rich Dad Poor Dad by Robert Toru Kiyosaki lays a strong foundation for lifelong financial education.

Q4: Can I start investing after reading it?

Yes—but only after expanding your financial education. Use Rich Dad Poor Dad by Robert Toru Kiyosaki as your starting point.

Q5: What’s the core idea in one line?

Make money work for you—don’t work for money.

Conclusion: Why You Must Read Rich Dad Poor Dad by Robert Toru Kiyosaki

To sum it up, Rich Dad Poor Dad by Robert Toru Kiyosaki is more than just a book—it is a mindset revolution. It teaches us that wealth is not earned merely through effort, but through education, investment, and strategic thinking.

In a rapidly changing economy, financial ignorance is dangerous. If you truly want to break free from the paycheck-to-paycheck cycle, let Rich Dad Poor Dad by Robert Toru Kiyosaki be your compass.

For more insightful book reviews and financial growth strategies, visit

👉 shubhanshuinsights.com

💬 We Want to Hear from You!

Have you read Rich Dad Poor Dad by Robert Toru Kiyosaki?

➡️ What was your biggest takeaway?

➡️ Did the book shift your views on jobs, income, or investment?

Drop your thoughts at shubhanshuinsights.com—let’s build financial freedom together.