A Random Walk Down Wall Street Summary: A Timeless Assault on Investment Illusions

In the vast and often deceptive world of investing literature, very few books have demonstrated the intellectual courage to challenge popular delusions with the clarity and precision found in A Random Walk Down Wall Street. This a random walk down wall street summary is written for serious readers who wish to understand why Burton G. Malkiel’s work continues to unsettle Wall Street professionals and empower ordinary investors decades after its first publication.

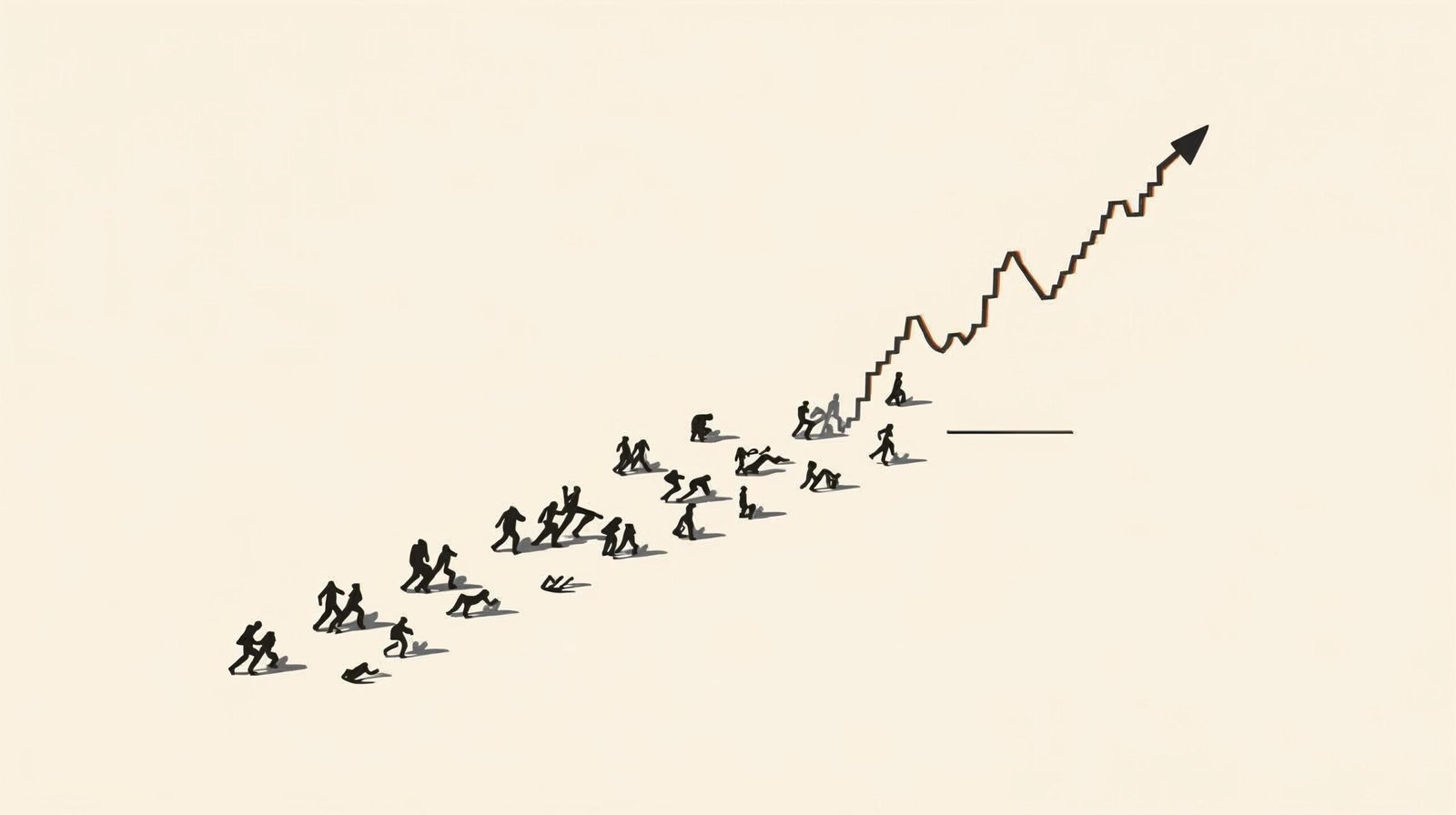

Unlike books that promise secret formulas or market-beating tricks, A Random Walk Down Wall Street dismantles the illusion of predictability itself. Malkiel’s thesis is both unsettling and liberating: stock prices move randomly, and consistent market outperformance is largely an illusion sustained by chance rather than skill.

This a random walk down wall street summary explores the book’s core arguments, intellectual foundations, and enduring relevance for modern investors navigating an era of information overload and financial noise.

The Meaning Behind the “Random Walk”

At the heart of this a random walk down wall street summary lies the concept of the random walk theory. According to Malkiel, price movements in financial markets reflect all known information almost instantly. As a result, tomorrow’s price movement is independent of today’s movement.

In simple terms, if information is already priced in, no amount of chart-watching, forecasting, or expert commentary can reliably predict future price changes. The market behaves like a drunkard’s walk—unpredictable, erratic, and immune to pattern-based forecasting.

This idea directly challenges the commercial foundations of active fund management, technical analysis, and market timing strategies.

Efficient Market Hypothesis Explained

One cannot understand this a random walk down wall street summary without addressing the Efficient Market Hypothesis (EMH), which forms the book’s intellectual backbone.

Malkiel explains three forms of market efficiency:

-

Weak-form efficiency – Past price movements cannot predict future prices.

-

Semi-strong efficiency – All publicly available information is already reflected in stock prices.

-

Strong-form efficiency – Even insider information cannot consistently generate excess returns.

While critics argue against the strong form, Malkiel convincingly demonstrates that most investors fail even against the weak or semi-strong forms, making active trading a losing proposition for the majority.

The Ruthless Critique of Technical Analysis

A crucial section of this a random walk down wall street summary is Malkiel’s systematic demolition of technical analysis.

Chart patterns, moving averages, and trend lines are exposed as psychological comfort tools rather than reliable forecasting instruments. Malkiel shows that once transaction costs, taxes, and timing errors are accounted for, technical strategies underperform passive alternatives.

The enduring popularity of technical analysis, he argues, owes more to human pattern-seeking behaviour than empirical success.

Fundamental Analysis Under the Microscope

While less dismissive of fundamental analysis, Malkiel remains sceptical. This a random walk down wall street summary explains how even rigorous company analysis rarely delivers sustained market-beating returns.

Professional analysts compete fiercely, ensuring that valuation discrepancies are quickly arbitraged away. Any apparent advantage disappears before the average investor can act.

Thus, even intelligent stock picking becomes a zero-sum game after costs.

Speculative Manias and Market Madness

One of the most engaging aspects of this a random walk down wall street summary is Malkiel’s exploration of historical speculative bubbles.

From the Dutch Tulip Mania to the dot-com boom, the book reveals how human greed, fear, and herd mentality consistently overpower rational judgement. These episodes demonstrate that while markets are efficient in the long run, they are emotionally irrational in the short term.

Malkiel’s warning is clear: speculation thrives not because it works, but because investors repeatedly forget history.

Why Index Investing Triumphs

The central prescription offered in this a random walk down wall street summary is the advocacy of low-cost index investing.

Malkiel demonstrates that index funds outperform the majority of actively managed funds over long periods due to:

-

Lower expense ratios

-

Reduced transaction costs

-

Tax efficiency

-

Broad diversification

Index investing removes emotion from decision-making and aligns the investor with overall market growth rather than futile attempts at market domination.

Asset Allocation: The True Driver of Returns

Another vital lesson in this a random walk down wall street summary is the importance of asset allocation.

Malkiel argues that long-term investment success depends more on how assets are allocated among stocks, bonds, and cash than on individual security selection. Proper diversification across asset classes reduces risk without sacrificing returns.

This principle empowers investors to focus on controllable factors rather than speculative forecasts.

Risk, Return, and Investor Psychology

This a random walk down wall street summary also emphasises the relationship between risk and reward. Higher returns are not free; they demand greater tolerance for volatility.

Malkiel cautions investors against confusing short-term price fluctuations with permanent loss. Emotional reactions to market movements often lead investors to sell low and buy high—the opposite of rational behaviour.

The Role of Bonds and Defensive Investing

Contrary to equity-centric enthusiasm, this a random walk down wall street summary highlights Malkiel’s balanced view on bonds.

He stresses that bonds play a stabilising role in portfolios, particularly for risk-averse or older investors. Ignoring bonds entirely exposes investors to unnecessary volatility and behavioural mistakes.

Behavioural Finance: A Quiet Acknowledgement

While Malkiel is a staunch defender of market efficiency, this a random walk down wall street summary recognises his nuanced acceptance of behavioural finance.

He acknowledges that investors are not always rational and that psychological biases can temporarily distort prices. However, he maintains that exploiting these inefficiencies consistently is extraordinarily difficult.

Relevance in the Age of Algorithms and AI

A modern a random walk down wall street summary would be incomplete without addressing contemporary markets.

Despite algorithmic trading, social-media speculation, and financial influencers, Malkiel’s thesis remains remarkably resilient. If anything, faster information dissemination strengthens market efficiency, making active outperformance even rarer.

Criticisms of the Random Walk Theory

This a random walk down wall street summary must also address criticism.

Opponents argue that anomalies such as value premiums, momentum effects, and behavioural biases contradict pure randomness. Malkiel counters that most anomalies weaken or vanish after discovery and transaction costs.

The debate continues, but the empirical failure of most active strategies remains undeniable.

Who Should Read This Book?

This a random walk down wall street summary makes it clear that the book is ideal for:

-

Long-term investors

-

Beginners seeking clarity

-

Professionals questioning conventional wisdom

-

Anyone tired of speculative hype

It is not suited for thrill-seekers chasing quick profits.

The Intellectual Discipline the Book Quietly Demands

One of the most underappreciated aspects of A Random Walk Down Wall Street is not its theory, but the intellectual discipline it demands from the reader. This a random walk down wall street summary would be incomplete without emphasising that Malkiel is not merely offering a strategy; he is demanding a psychological transformation. The investor must abandon the seductive belief that superior intelligence, faster information, or sharper instincts guarantee superior returns.

Such intellectual humility is rare. Most investors prefer narratives that affirm their uniqueness. Malkiel offers the opposite: evidence that markets reward discipline, not brilliance.

This lesson becomes increasingly uncomfortable the more educated the investor becomes, for education often breeds overconfidence rather than restraint.

The Illusion of Professional Superiority

Another critical dimension worth expanding in this a random walk down wall street summary is Malkiel’s sustained critique of professional money managers. The book marshals decades of data demonstrating that professional fund managers, despite privileged access to research teams and corporate management, fail to outperform broad market indices over time.

This is not an indictment of intelligence, but of structure. When thousands of highly trained professionals analyse the same information simultaneously, competitive advantages cancel each other out. What remains are fees, taxes, and turnover—each of which erodes returns.

The implication is sobering: if professionals cannot consistently win, the odds for individual investors are even less favourable.

Media, Forecasting, and the Theatre of Certainty

Modern financial media thrives on confidence. Predictions, price targets, and expert panels dominate headlines. Yet this a random walk down wall street summary underscores how Malkiel exposes forecasting as performance rather than precision.

Forecasts provide psychological comfort, not statistical reliability. Markets demand narratives, and media supplies them. The accuracy of these narratives, however, is rarely audited with intellectual honesty.

Malkiel’s argument suggests that the constant consumption of market commentary may actively harm investors by encouraging unnecessary action, emotional reactions, and false urgency.

Why Activity Is the Enemy of Returns

One of the most counterintuitive insights explored further in this a random walk down wall street summary is the destructive role of excessive activity. Trading feels productive. Holding feels passive. Yet the evidence overwhelmingly favours inactivity.

Each trade introduces friction: commissions, spreads, tax liabilities, and timing errors. Over decades, these small frictions compound into significant underperformance.

Malkiel’s work implicitly elevates patience to a financial virtue. Doing nothing—when guided by a sound asset allocation—often proves superior to constant adjustment.

The Moral Neutrality of Markets

Markets, Malkiel insists, are morally indifferent. This a random walk down wall street summary expands on his insistence that markets do not reward effort, sincerity, or ethical intent. They reward risk-bearing and time exposure.

This insight is vital because many investors subconsciously expect fairness from markets. They believe good research should be rewarded, hard work should be compensated, and intelligence should prevail.

Markets offer no such guarantees. Accepting this reality is emotionally difficult but strategically liberating.

Long-Term Wealth Is Built, Not Discovered

Another powerful expansion point in this a random walk down wall street summary is the distinction between wealth creation and wealth discovery. Speculators search for hidden opportunities; investors build wealth incrementally.

Malkiel aligns investing with engineering rather than exploration. The goal is not to find treasure, but to construct a durable system that survives uncertainty.

This system relies on diversification, low costs, periodic rebalancing, and unwavering adherence to long-term goals.

The Tyranny of Short-Term Performance

Short-term performance metrics dominate modern investing culture. This a random walk down wall street summary highlights how Malkiel exposes their tyranny.

Quarterly rankings, annual returns, and short-term benchmarks encourage destructive comparisons. Investors abandon sound strategies simply because they temporarily lag fashionable alternatives.

Malkiel’s framework demands a longer horizon—measured in decades rather than months. Only over extended periods does the statistical advantage of disciplined investing reveal itself.

Risk Is Not Volatility Alone

Many investors equate risk with price fluctuation. This a random walk down wall street summary deepens Malkiel’s clarification that true risk is the probability of failing to meet long-term financial objectives.

Short-term volatility is a feature, not a flaw, of equity investing. Attempting to eliminate it often increases long-term risk by reducing exposure to growth assets.

Understanding this distinction allows investors to tolerate temporary discomfort in exchange for durable outcomes.

Education Without Execution Is Useless

One of the quieter warnings embedded in this a random walk down wall street summary is that knowledge alone does not guarantee success. Many investors understand Malkiel’s arguments intellectually yet fail to implement them emotionally.

Fear during downturns and greed during rallies override rational frameworks. Execution, not education, becomes the limiting factor.

Malkiel’s philosophy therefore demands behavioural discipline equal to analytical understanding.

The Book as an Antidote to Financial Arrogance

This a random walk down wall street summary ultimately presents the book as an antidote to financial arrogance. It strips away the illusion that markets can be mastered through cleverness alone.

Instead, it replaces arrogance with structure, prediction with probability, and excitement with endurance.

Such an approach may appear dull, but it is precisely this dullness that compounds into extraordinary long-term results.

Enduring Lessons for the Patient Investor

As a final expansion, this a random walk down wall street summary reinforces that Malkiel’s ideas endure because human behaviour does not change. Technology evolves, instruments multiply, and narratives shift, but fear and greed remain constant.

Markets may look different, but the investor’s psychological vulnerabilities remain unchanged.

Malkiel’s work succeeds because it addresses the investor, not the market.

The Quiet Power of Boredom in Investing

One of the most paradoxical virtues emphasised by Malkiel’s philosophy is boredom. In an era that glorifies speed, complexity, and constant engagement, boredom appears undesirable. Yet in the discipline of long-term investing, boredom often signals correctness. A well-constructed portfolio does not demand constant attention, nor does it generate frequent excitement. It functions quietly, steadily, and with remarkable resilience.

This perspective challenges the modern investor’s craving for stimulation. News alerts, market commentary, and rapid price movements create the illusion of necessity. In reality, excessive engagement frequently leads to overreaction, unnecessary turnover, and emotional fatigue. The absence of drama is not a weakness; it is evidence of sound design.

Boredom also encourages patience, a trait that financial markets reward unevenly but generously over time. Investors who accept periods of monotony are less likely to abandon rational strategies during temporary declines or euphoric rallies. They allow compounding to perform its slow, almost invisible work.

Moreover, boredom cultivates independence of thought. Without the constant influence of external noise, investors are better positioned to evaluate decisions against long-term objectives rather than short-term impulses. This internal alignment reduces the temptation to chase trends or mimic popular opinion.

Ultimately, the quiet power of boredom lies in its ability to shield investors from their own worst instincts. It transforms investing from a source of anxiety into a disciplined, almost mechanical process. In doing so, it reinforces the central message of Malkiel’s work: enduring success rarely announces itself loudly, but it rewards those willing to remain still while others rush toward uncertainty.

FAQs

1. What is the core idea of A Random Walk Down Wall Street?

The core idea, as explained in this a random walk down wall street summary, is that stock prices move unpredictably, making consistent market outperformance extremely unlikely.

2. Does the book recommend index funds?

Yes. This a random walk down wall street summary confirms that Malkiel strongly advocates low-cost index investing.

3. Is the book still relevant today?

Absolutely. This a random walk down wall street summary shows that modern markets reinforce, rather than weaken, Malkiel’s conclusions.

4. Does Malkiel reject all active investing?

Not entirely, but this a random walk down wall street summary makes clear that most active investors underperform after costs.

5. Is this book suitable for beginners?

Yes. This a random walk down wall street summary highlights its accessibility and logical clarity for new investors.

Conclusion: A Cold Shower for Overconfident Investors

This a random walk down wall street summary reveals a book that does not flatter the reader’s ego. Instead, it delivers a disciplined, evidence-based dismantling of investment myths that continue to enrich intermediaries while impoverishing individuals.

Burton G. Malkiel’s message is profoundly uncomfortable: humility beats brilliance, patience defeats prediction, and simplicity triumphs over sophistication.

In a world obsessed with shortcuts, A Random Walk Down Wall Street offers something far more valuable—truth.

For readers seeking rational investing wisdom grounded in decades of research and intellectual honesty, this book remains indispensable.

Read more deeply reasoned financial insights at:

👉 shubhanshuinsights.com

Where speculation ends and understanding begins.

Such restraint, rarely celebrated, ultimately separates enduring financial wisdom from fleeting market theatrics and preserves capital, confidence, and clarity across generations worldwide.